Never Bet Against Human Ingenuity

Why Staying Fully Invested in Stocks Beats Chasing Safety: The Myth of "Safe" Assets in a Risky World

"Despite some severe interruptions, our country's economic progress has been breathtaking. Our unwavering conclusion: Never bet against America." - Warren Buffett

Look, Warren Buffett says don't bet against America. Fine. Sensible enough in a folksy, grandfatherly kind of way. But let's be real, America isn't some monolithic, unchanging entity. It's a messy, dynamic system, and what drives it, what drives everything, is human ingenuity.

That’s not confined to any one country, let alone a zip code in California. Silicon Valley is a state of mind—a global, interconnected network of caffeinated strivers trying to build the future, one line of code, one venture capital pitch deck at a time.

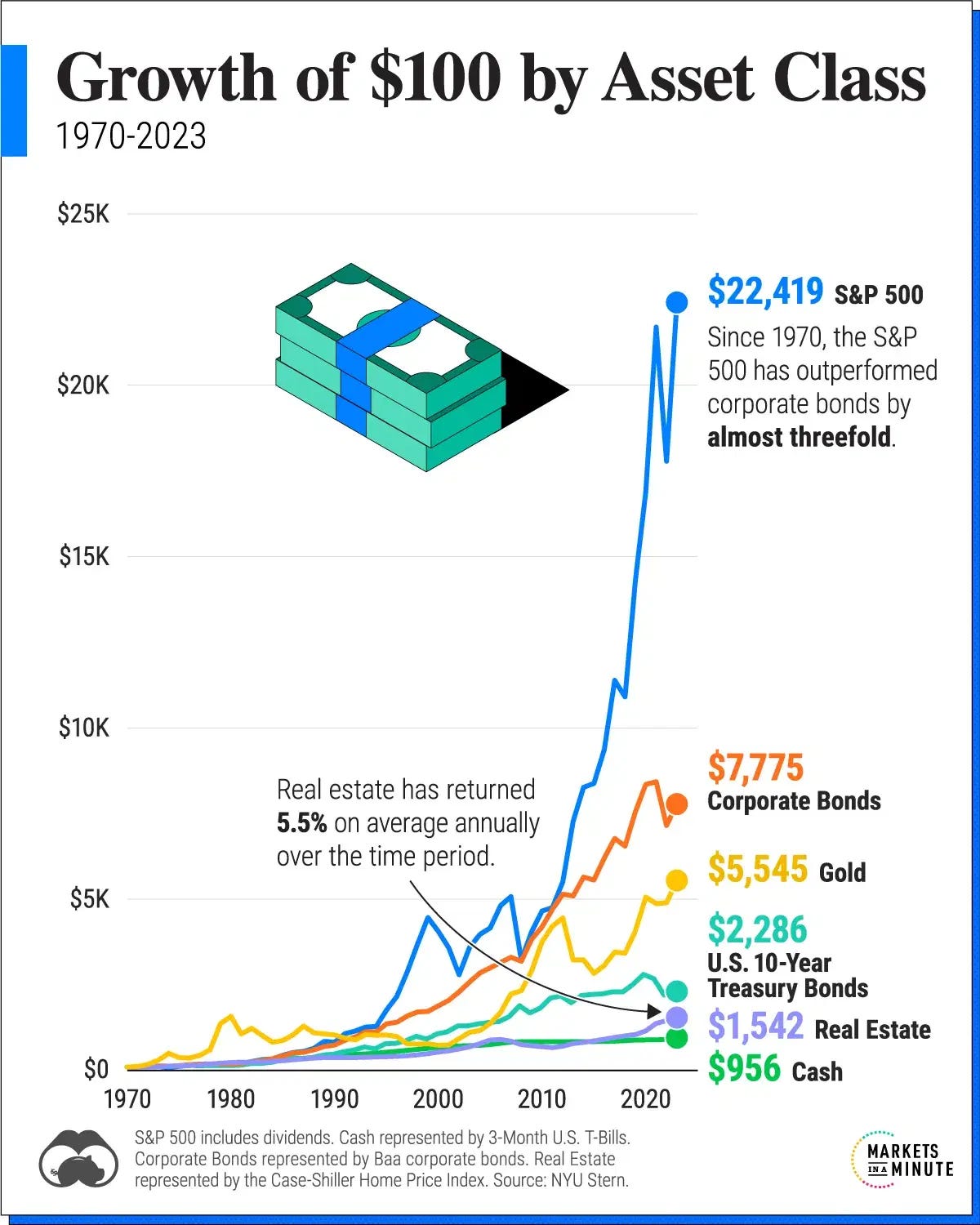

How do you invest in human ingenuity? You buy companies. The messy, ambitious, occasionally-delusional companies listed on stock exchanges worldwide. They’re the vehicles for this ingenuity, the engines of progress.

Now, what happens when you bet against ingenuity? You load up on "safe" assets. Cash, real estate, commodities. You're essentially saying, "I bet humans won't figure out a better way to do things." And history, my friends, is a long, hilarious graveyard of people who made that bet.

Examples of betting against human ingenuity by buying “safe” assets

1) Cash

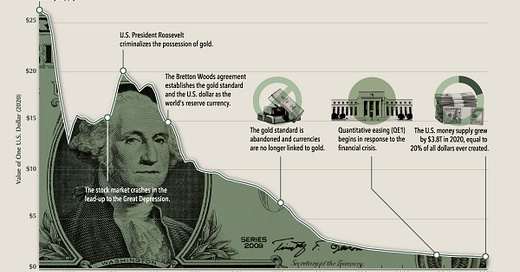

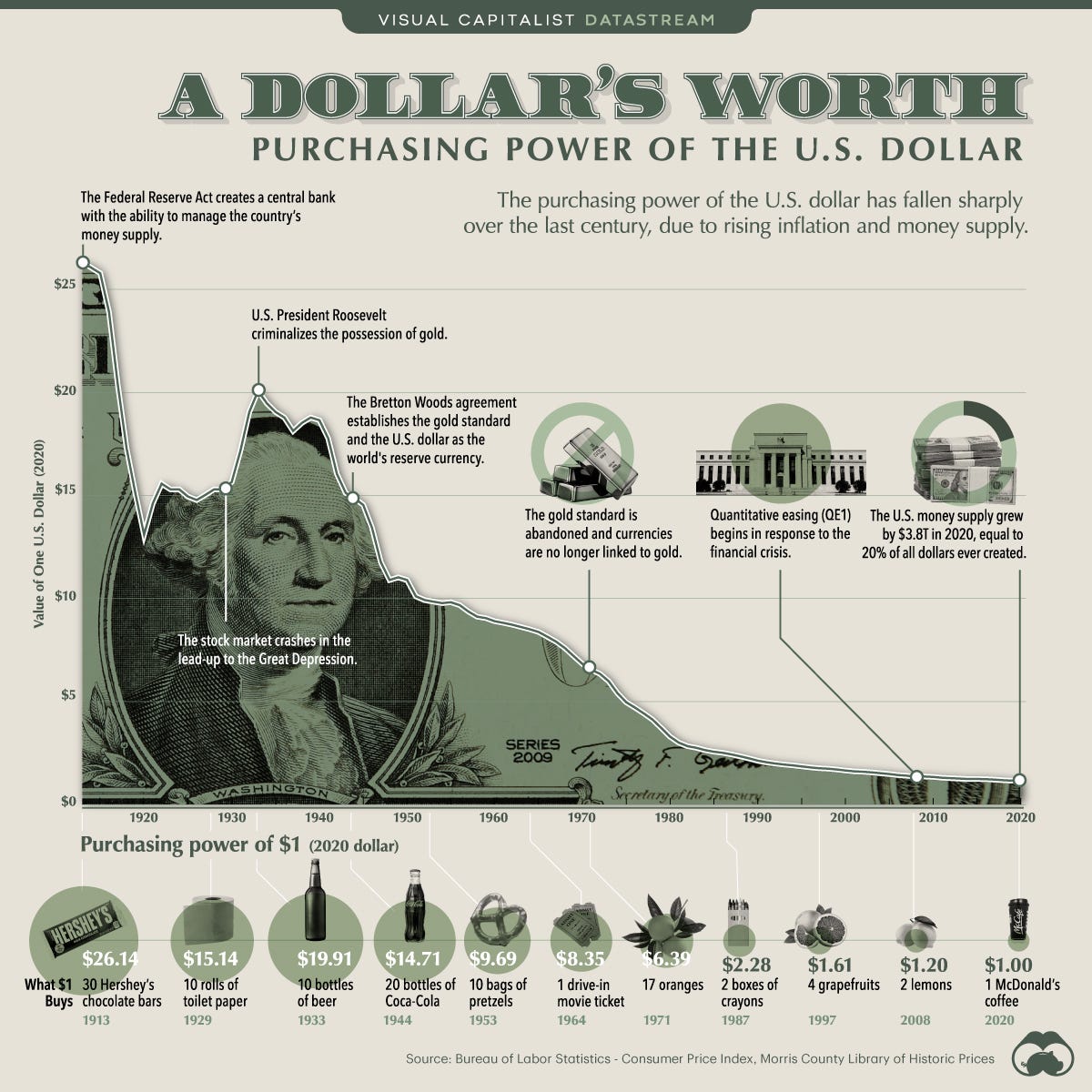

Take cash. A dollar from 1913 buys you…well, not much a century later. It's lost 96% of its value!

Take cash. A dollar in 1913 buys you… well, not much in 2023. It's lost 96% of its value! Meanwhile, the Dow is up, what, like a bazillion percent since then? (Okay, 69,247%, but who’s counting?).

Inflation, you see. Governments need inflation. It greases the wheels, encourages spending, and quietly erodes their mountain of debt. Great for the economy, terrible for your cash hoard.

2) Real estate

Then there’s real estate. Remember San Francisco? Prime office space for the fast-growing tech industry, the hottest ticket in town. Then boom, pandemic. Suddenly, Zoom calls are a thing, and those gleaming towers are ghost towns. Values down 80% and vacancy rates through the roof, skyrocketing from 3% in 2019 to 30% in 2023. Oops.

Residential real estate? Demographics, remote work, zoning reform… all these forces swirling around, making it a much more complicated bet than it seems. Ingenuity finds a way, sometimes in ways you don't expect.

3) Commodities

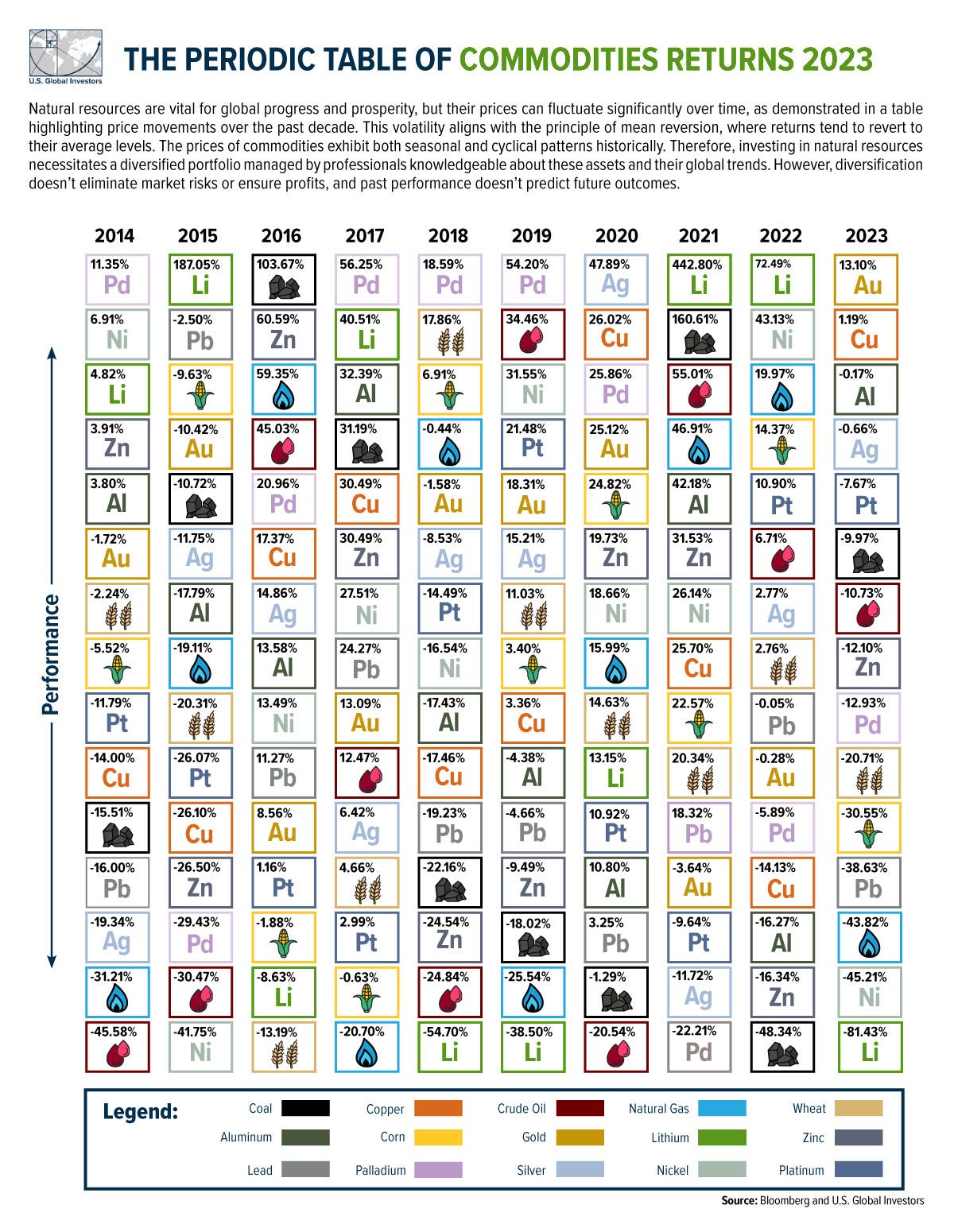

The best performing commodities in one year can be the worst performers in the following year.

2014 -> 2015: nickel dropped from #2 (+7%) to last (-42%)

2015 -> 2016: lithium dropped from #1 (+187%) to second last (-9%)

2016 -> 2017: natural gas went from #3 (+59%) to last (-21%)

2017 -> 2018: lithium went from #2 (+41%) to last (-55%)

2019 -> 2020: oil went from #2 (+34%) to last (-21%)

2020 -> 2021: silver went from #1 (+48%) to second last (-12%)

2021 -> 2022: coal dropped from #2 (+161%) to last (-48%)

2022 -> 2023: lithium, nickel, and natural gas fell from #1 (+72%), #2 (+43%), and #3 (+20%) respectively to first (-81%), second (-45%), and third last (-44%)

"I've seen gluts not followed by shortages, but I've never seen a shortage not followed by a glut." - Nassim Taleb

Taleb nailed it: shortages lead to gluts. High prices incentivize innovation.

Expensive coal? Hello, natural gas.

Expensive oil? Electric cars.

Expensive nickel for NCM (nickel-cobalt-manganese) batteries? LFP (lithium-iron-phosphate) batteries to the rescue.

Expensive lithium? Scientists are already tinkering with sodium-ion batteries.

Commodities are a zero-sum game. You're betting on scarcity, and ingenuity is constantly working to undermine you.

The power of human ingenuity

The real magic, the only truly appreciating asset in the long run, is human ingenuity itself. It's the ultimate exponential curve.

Human ingenuity is the only resource on the planet that gets more valuable over time, as humans discover new and better ways to do more with less.

Technology lets you do "more and more with less and less until eventually you can do everything with nothing." - Buckminster Fuller

Cash, real estate, commodities – those are the "less and less." Companies1, driven by human ingenuity, capture the "more and more."

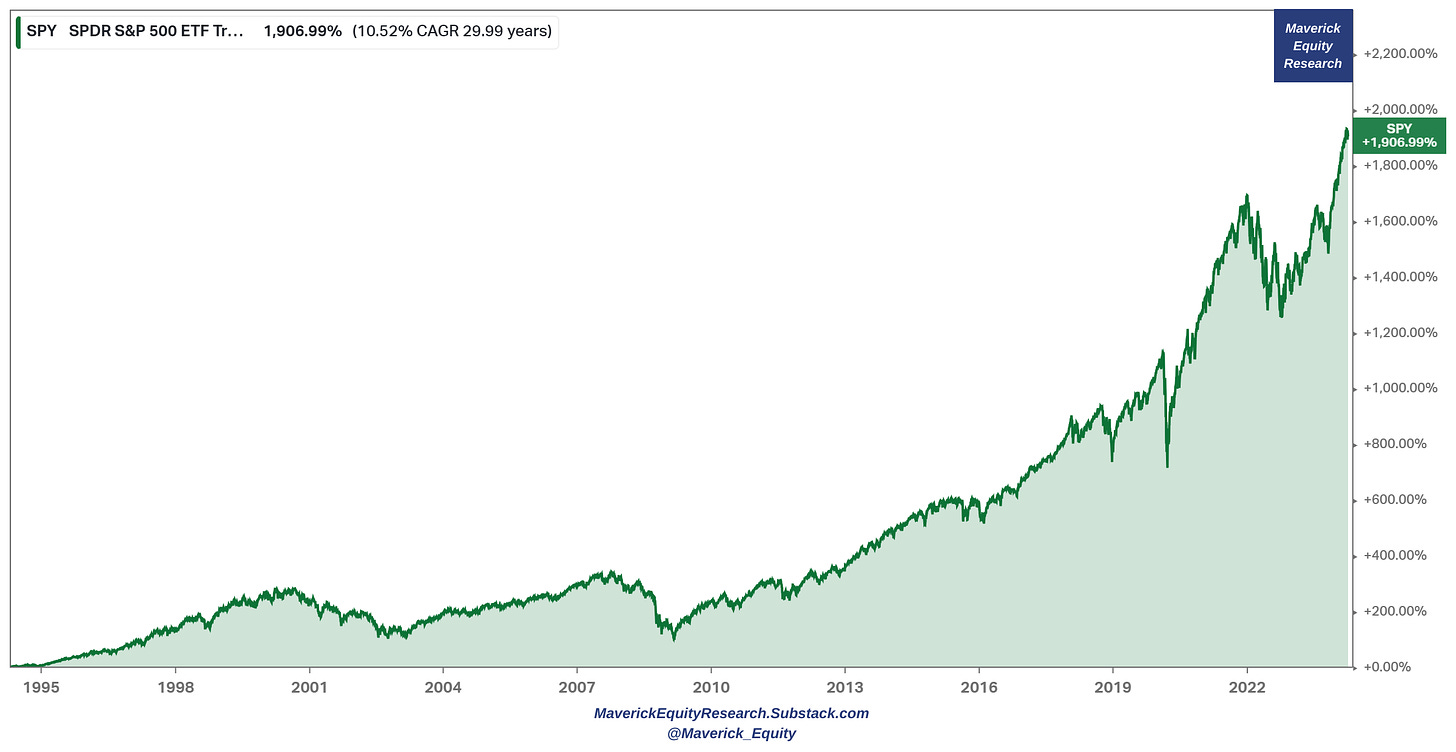

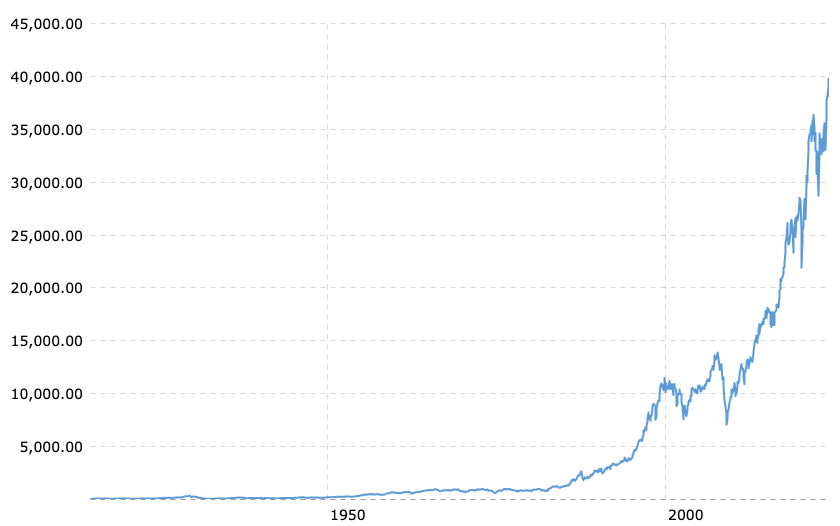

Look at the S&P 500. Sure, it has its ups and downs, its bear markets and corrections. But the long-term trend? Relentlessly up. 1,907% over the last 30 years. A 10.52% compounded annual growth rate.

That’s the power of human ingenuity, compounded over time. So, yeah, don't bet against America. But more importantly, don't bet against the relentless, chaotic, beautiful force of human ingenuity. It’ll eat you alive.

This Substack Will Always Be Free to Read

If you liked this post, please subscribe and pledge to subscribe.

We'll never charge readers a penny; feel free to input a credit card that expires tomorrow. It will help us with the Substack algorithm. Thank you.

Subscribe for lessons from an experienced investor who's made millions from the market and zero stock tips, other than buy the S&P 500.

About

Inverteum is a proprietary trading firm that specializes in long-short algorithmic strategies to generate returns in both bull and bear markets.