Bill Gurley on the dangers of regulatory capture

Regulation helps existing companies at the expense of innovative startups

TL;DR

Bill Gurley has a point: Regulation tends to help the big players and hurt the little guys. This is a theme that comes up often when you're talking about regulatory capture.

“As a rule, regulation is acquired by the industry and is designed and operated primarily for its benefit.” - George Stigler, winner of the 1982 Nobel Prize in Economics

“Regulation is the friend of the incumbent.” - Bill Gurley

Regulatory capture and four examples

Regulatory capture is one of those fun little concepts where a special interest group—often a big industry—gets the government to work for them, and not for you, the hapless consumer. So instead of regulation being about the public good, it becomes about protecting entrenched players and stifling competition. The result is usually higher prices, fewer choices, and a general feeling that we're all getting played.

The way it works is pretty straightforward: Companies—especially the big ones—spend a lot of time, money, and effort influencing policy in Washington. This got a little more efficient after Citizens United (which, you may recall, made it easier for companies to throw money into politics). They also have this charming habit of shuffling people between the corporate boardroom and regulatory agencies, which makes it even easier to ensure that the rules work in their favor.

And there’s a long history of this. For instance, Morgan Stanley put out a research report in 1999 that said:

“The recent history of industry intervention in the US leads us to conclude that landmark regulatory action has the tendency to improve returns for the largest players in the targeted industry over an intermediate-time horizon. Long-term investors should consider capitalizing on any temporary weakness caused by market reaction to regulation. Many attempts to increase competition or improve customer experience have failed to deliver on the promise.” (emphasis added by Gurley)

- Morgan Stanley research report (1999)

In other words, regulation is supposed to help consumers, but it often just helps the big guys. And the small guys? They get crushed. Let's talk about how this works with some examples.

1. How the 1996 Telecommunications Act killed innovation in telecommunications

D.C. corruption and how AT&T, Verizon, and Comcast stopped the creation of citywide Wi-Fi networks

Bill Gurley’s fourth VC investment was in a company called Tropos Networks. Tropos built industrial-grade mesh Wi-Fi networks and wanted to partner with cities to provide free Wi-Fi. You can see where this is going—hundreds of mayors across the country loved the idea. But you know who didn’t love it? Verizon, Comcast, and AT&T.

When Philadelphia tried to roll it out in 2004, Verizon successfully got a bill through the Pennsylvania legislature to stop it. And not just in Philly—within a couple of years, over 22 states passed laws that essentially outlawed municipal broadband.

Gurley has a great anecdote about this. Back when he was trying to push for Tropos, he hired a lawyer in D.C. This lawyer found a Congressman who was on the committee that controlled telecom policy and arranged a meeting. But there was a catch: Gurley needed to get 10-12 people, and their spouses, to write $5,000 checks to the Congressman. This totaled $120,000, but it was structured as 24 separate $5,000 donations, so it wouldn’t look like a single corporate donation from Tropos.

Two more of these “meetings” later, Gurley threw in the towel. AT&T, Verizon, and Comcast had already made it nearly impossible for cities to create their own broadband networks.

The states took the power of these local decision makers away from them, in the interest of the telecom companies, not the citizens.

Telecommunications Act (1996)

The 1996 Telecommunications Act was held up as the most important telecommunications reform in 62 years. The idea was to promote competition and encourage the development of new technologies. Sounds great, right? Except that's not what happened.

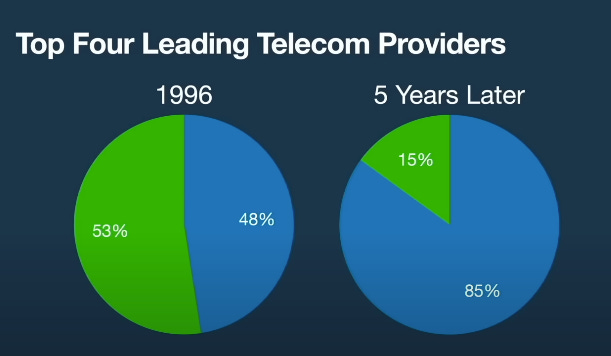

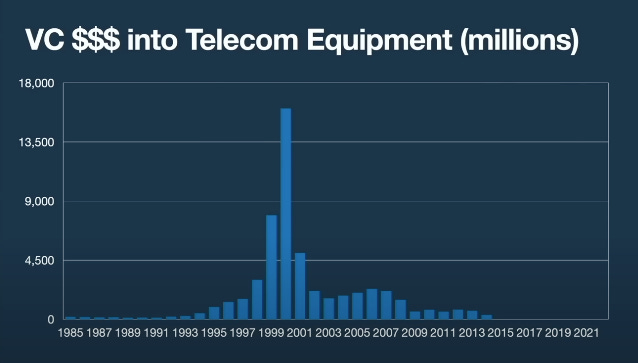

The kicker? The 1996 Telecommunications Act didn’t lead to more competition. Instead, the top four telecom companies saw their market share grow from 48% to 85% in five years.

Venture capital funding for telecom equipment went from 15% of VC funding to less than 1% by 2006.

So the law meant to promote competition ended up killing innovation in telecom.

2. Dodd-Frank (2009) basically stopped the creation of new banks

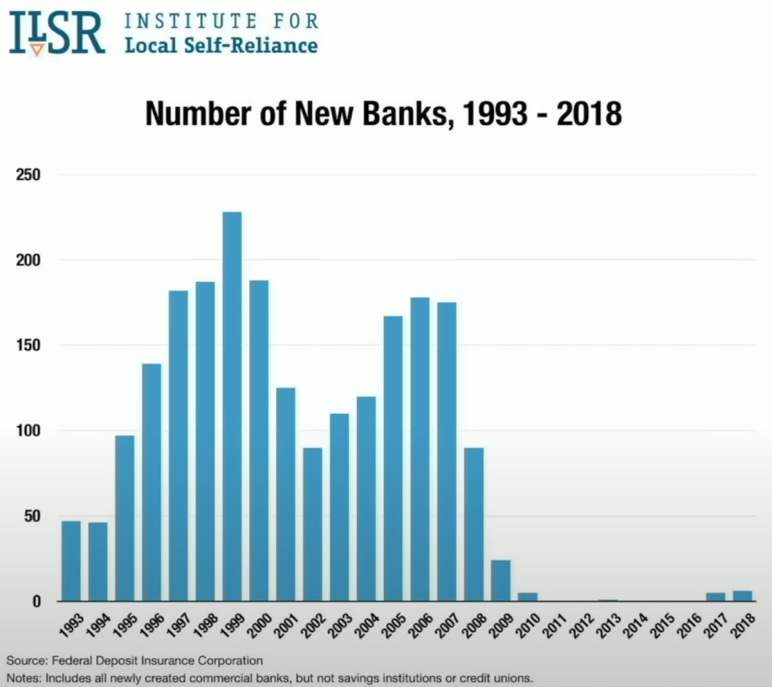

Let's move from telecom to banking. Dodd-Frank was supposed to make the banking system safer after the 2008 financial crisis. But what it mostly did was make it harder for new banks to get started. The number of new bank charters in the U.S.? Pretty much zero after Dodd-Frank. It turns out that when you pile on regulations, only the big banks can afford to comply. Small banks and new entrants? Not so much.

3. How Epic Systems used the HITECH Act to strangle competition

Epic Systems is a very large private company in Wisconsin that is the largest player in electronic health records (EHR) software.

Obama appointed founder/CEO Judith Faulkner to his Health Information Technology Policy Committee. Faulkner was a major Obama donor.

When Obama passed the HITECH Act in 2009, it included incentives for doctors to adopt EHR systems. But there was a catch: your software had to meet certain thresholds to qualify for the incentive payments. And guess whose software met those thresholds? Epic’s.

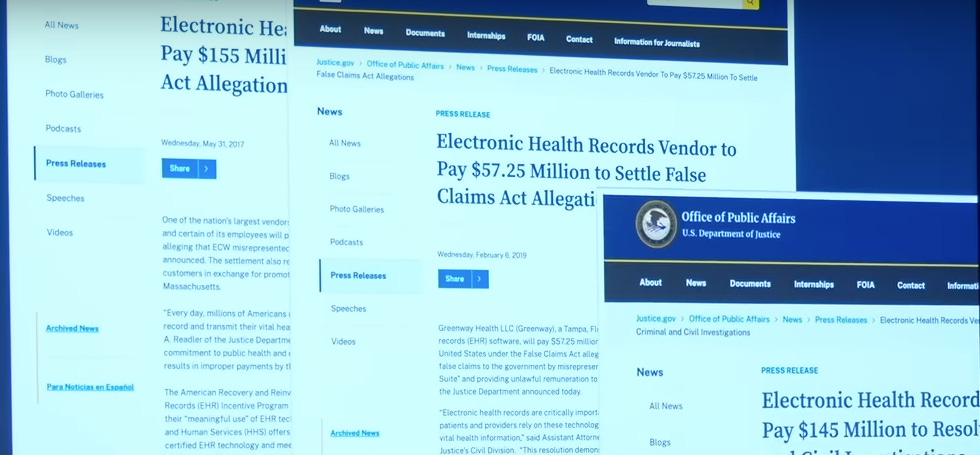

The Department of Justice even started fining companies whose software didn’t meet the Epic-friendly requirements (Epic’s competitors) $57-155 million.

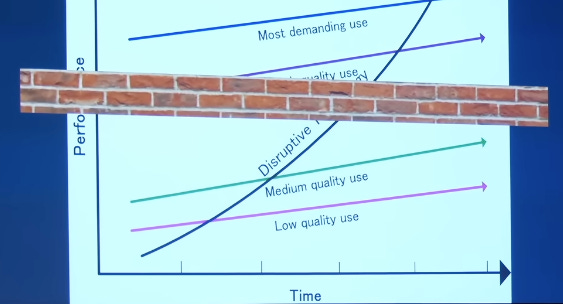

The result? Epic became the dominant player, and startups that could have disrupted the industry were blocked from moving up the value chain.

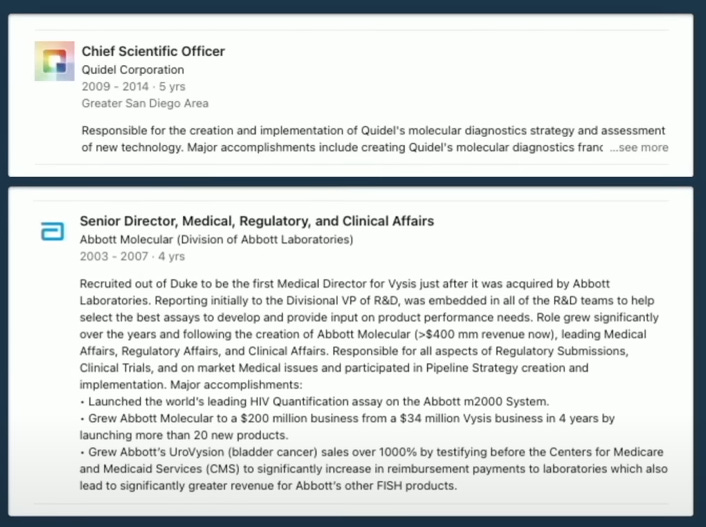

4. How an ex-Abbott Labs executive banned competing covid tests as an FDA official

During the pandemic, Germany and the UK approved dozens of covid test vendors, which drove prices down. In Germany, a test cost €0.75 ($0.80). In the UK, it was $1.50. In the U.S., though? We had three approved vendors, and tests cost $7.

Why? Timothy Stenzel, the FDA official in charge of approving antigen tests, used to work for Abbott Labs—one of the three approved vendors. So, instead of having lots of competition and lower prices, the market was just a cozy little club of three companies.

D.C. politicians want to bring Silicon Valley under their control so they can raise more money

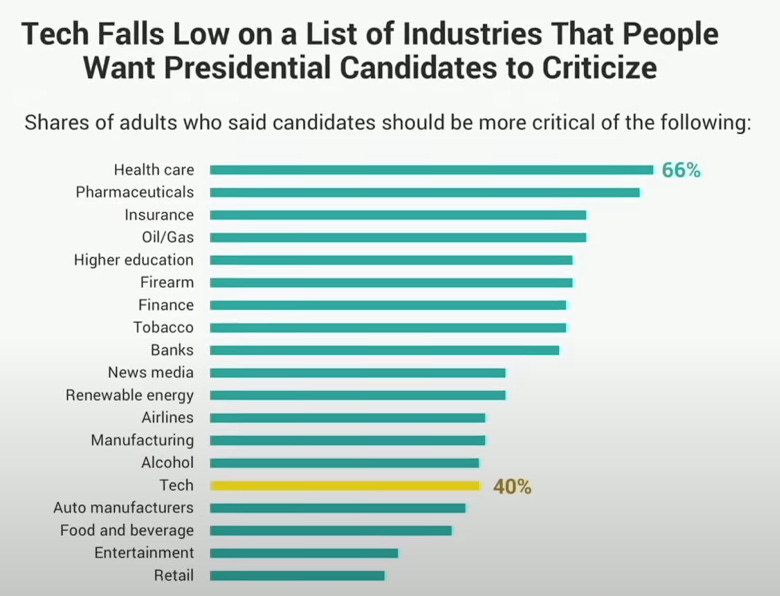

Washington is now turning its sights on Silicon Valley, even though regulatory capture is far more damaging in industries like healthcare, finance, and telecom and voters care more about these industries than tech.

Why? Because where there’s regulation, there’s money. And politicians want tech companies to start opening their wallets, just like defense, finance, and telecom have for decades.

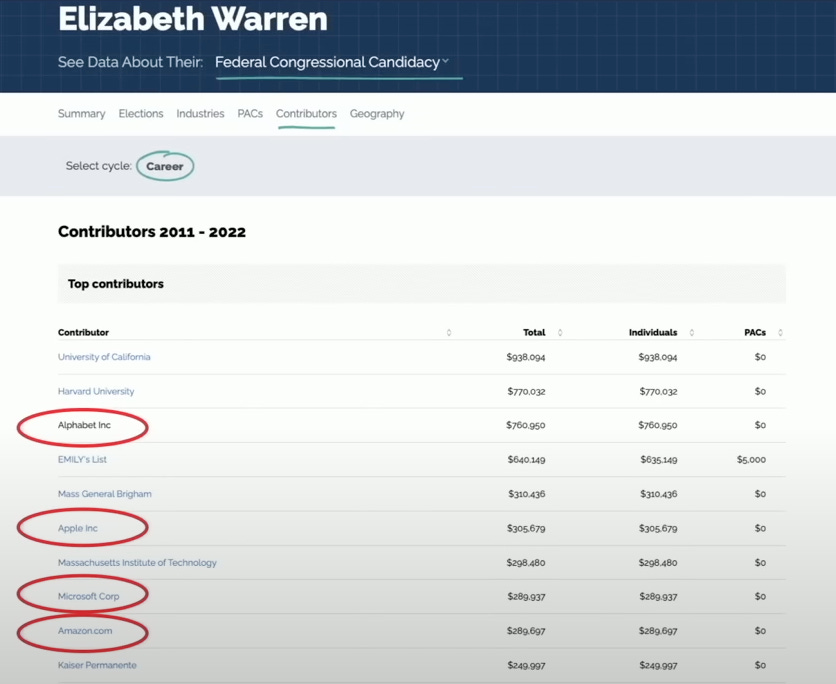

Four of the top 10 contributors to Elizabeth Warren are tech companies: Alphabet, Apple, Microsoft, Amazon.

The message is clear: if you want favorable regulation, you need to pay up.

Silicon Valley executives to D.C.: “Please regulate us”

Some Silicon Valley leaders are now actively asking for regulation. Why? Because they know they can shape the rules to favor them and keep competitors out.

Brian Armstrong (Coinbase), Mark Zuckerberg (Meta), and Sam Altman (OpenAI) have all called for regulation in their respective industries.

Gurley thinks this is especially concerning in AI, where the incumbents are pushing a negative message about open source. Why? Because open source is their biggest threat.

Three takeaways

A) We’re not very good at regulation

All four stories above are examples of regulatory failures. Regulation often ends up doing more harm than good.

Senator Patrick Monahan once suggested that Congress should take a Hippocratic Oath: “First, do no harm.” He felt personally responsible for the homeless situation in America because he signed an act with JFK in 1963 that shut down the mental health institutions.

B) Regulatory capture gives capitalism a bad name

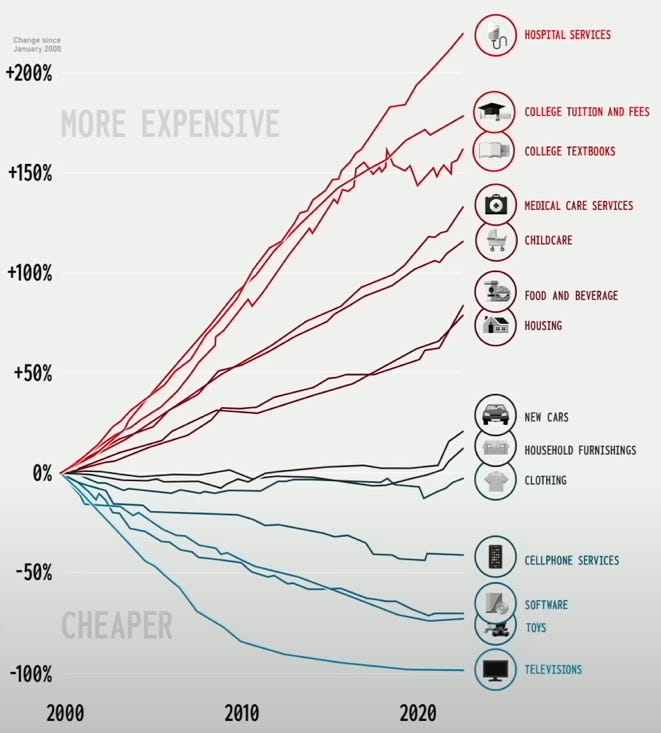

People like to say that capitalism is broken, but it's really regulatory capture that's the problem. In industries like healthcare and education, where regulatory capture is rampant, prices keep going up.

Meanwhile, in competitive industries like tech, prices are dropping.

C) Technology, commerce, and the sharing of ideas leads to prosperity

Gurley’s big fear is that regulation stifles innovation. And if you kill innovation, you kill prosperity.

2,851 Miles

The title of Gurley’s talk is “2,851 Miles.” That’s the distance from Sand Hill Road in Silicon Valley to Washington, D.C.

“The reason Silicon Valley has been so successful is because it's so f—ing far away from Washington, D.C.” - Gurley

Full Video

The entire talk is well worth watching if you’ve got the time.

This Substack Will Always Be Free to Read

If you liked this post, please subscribe and pledge to subscribe.

We'll never charge readers a penny; feel free to input a credit card that expires tomorrow. Pledges will help us with the Substack algorithm. Thank you.

Subscribe for lessons from an experienced investor who's made millions from the market and zero stock tips, other than buy the S&P 500.

About

Inverteum is a proprietary trading firm that specializes in long-short algorithmic strategies to generate returns in both bull and bear markets.